See the bottom of this article for details of a free Webinar hosted by Xero (you don’t need to use Xero to access this webinar)

What is the VAT reverse charge?

The government is changing the way that HMRC collects VAT payments.

Until now, businesses in the construction industry would usually charge VAT when selling their materials or services, regardless of whether they are dealing with clients, contractors, subcontractors, etc.

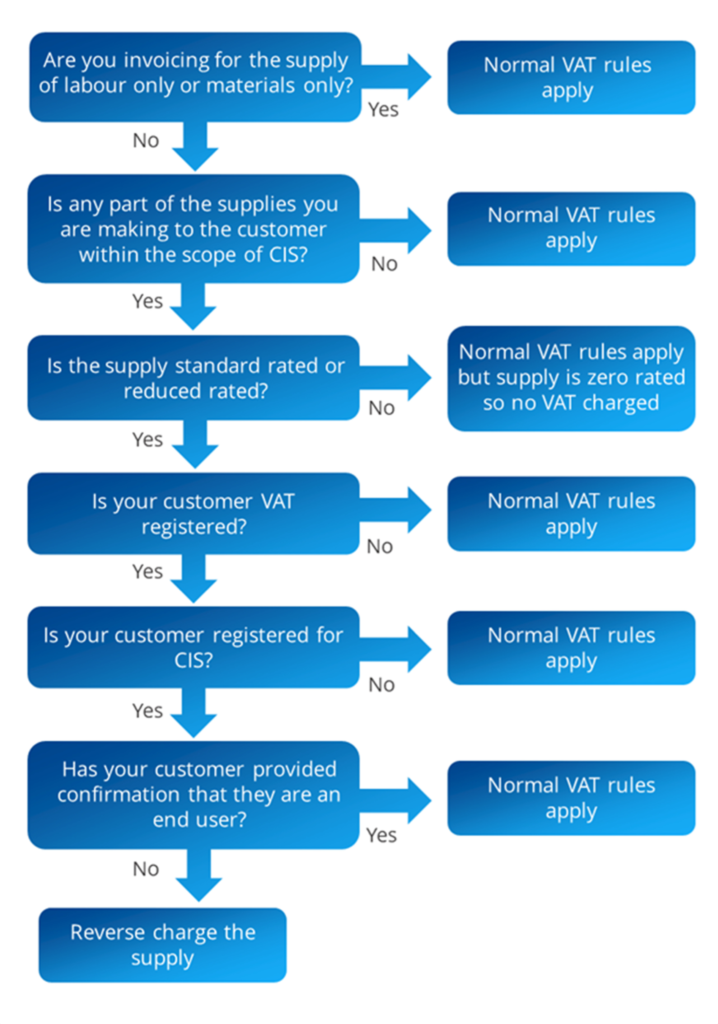

As of March 1st, 2021, suppliers will not be allowed to charge VAT unless they are supplying services to an “end-user”. For those transactions, they must only invoice for and collect the amount excluding VAT. Instead of paying the VAT to the supplier, the customer will pay the VAT directly to HMRC.

Who is classed as an “end-user”?

Final customers are referred to as “end users” in the guidelines. Anyone who will either use, rent or sell the structure in question is an end-user, so for example:

- Landlords

- Developers

- Domestic householders

- Local authorities

- Utility companies

Of course, this is made a little more complicated by the fact that “intermediary suppliers” are also treated as end-users, so if you deal with those, you can continue to charge them VAT too.

Your customer should confirm in writing that they are an end-user. (See Example End User Statement)

HMRC’s technical guide offers some further clarification on this distinction and what you should do to determine how your customers should be classified.

1. Read the government’s official advice.

We highly recommend scanning through the guidance published by HM Revenue & Customs for a better understanding. There are a lot of pointers there which are specific to different situations.

2. Talk to CGA

You will also be able to get more personalised advice CGA. We can help you understand what the biggest impact will be on your business, given the way you work and what steps you should take.

3. Consider how you handle your VAT returns.

It is common for contractors to do their VAT returns on a quarterly basis. If that is what you do, consider changing to monthly. Although it might require more admin in the short term, this may help balance out the effect on your cash flow.

4. Update your invoicing system.

You will need to review your invoices and potentially remove VAT from a lot of them moving forward. Make sure this is as systemised and automated as possible!

Invoices sent after 1 March 2021 will need to contain wording explaining that they are reverse charge invoices and will look something like our example.

They will not show VAT in the columns which calculate the payment to be made. On the following page there is an example invoice where no end-user certificate has been supplied.

See the example invoice.

The example invoice is not prescriptive – legally you do not have to show the VAT number of the customer, but it evidences that you have checked that they are registered and is good practice.

Your software system may not let you calculate the VAT that is being reverse charged and print it outside the accounting column. If you cannot show it, don’t worry. The recipient of the invoice will have to do the calculation themselves.

Use your software system to record as much information about your customer/supplier as possible.

What is important is that your invoice does not charge VAT and clearly shows that it is a reverse charge invoice and S55A applies.

5. Write to your subcontractors.

When your subcontractors invoice you for their services, they can no longer charge you VAT under the new rules, because you will owe it to HMRC directly instead. We suggest writing to them to confirm this, advise them on where to go for more information, and maybe offer to discuss further if needed. (See example letter to sub-contractors)

6. Write to your Customers (Intermediaries and End Users) – You need to establish if your customer is an intermediary or end user – they may be both.

See example letter to customers.

In deciding whether you are working for an end user you must ask yourself who you are actually contracted with, who are you expecting to pay you. Do not think about the final client if you will not be directly contracted to or paid by the final client. Ask yourself, is the firm that you work for going to be the end user of that building or construction activity?

Sometimes you will contract with a group company that is acting for another company in its own group as a property procurement company, it is an intermediary for the end user.

Sometimes you will work for a landlord who is acting for a group of tenants to procure and organise work.

The tenants are the end users and the landlord is an intermediary.

If a business is acting as an intermediary and is VAT registered and CIS registered and the work you are doing is standard rated construction work, you must reverse charge VAT unless the intermediary gives you an end user statement.

Intermediaries acting for groups or for tenants are allowed to issue end user statements. If they give an end user statement there is no need to question it or to enquire about the structure of the group companies, or the landlord tenant contract in any detail – if you hold an end user statement you must charge VAT.

FREE Webinar – Managing Reverse Charge VAT and CIS

Next week, on 26th February at 10am Xero are running a free webinar for construction businesses, outlining the Reverse Charge VAT changes and giving tips on how to prepare. This session is open to all construction businesses, regardless of whether they currently use Xero.

We welcome you to join by clicking this registration link

The 45 minute webinar will cover:

- What Domestic Reverse Charge VAT is

- How it will affect both contractors and subcontractors

- How to prepare for the mandatory change

- How Xero can help manage Domestic Reverse Charge VAT and CIS