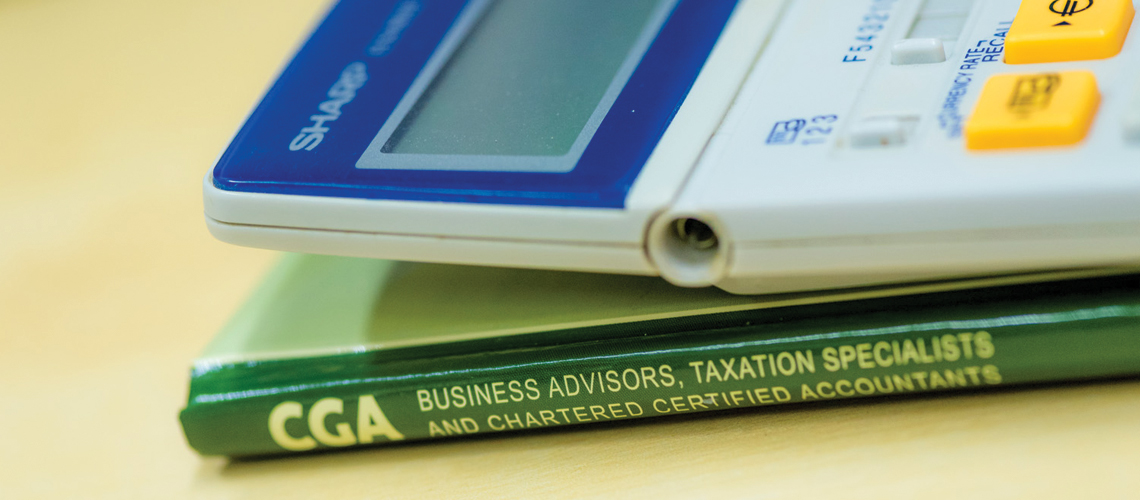

March 2023 Budget

Although the tone of the Chancellor was very upbeat, the reality of the budget was clearly “steady as we go” against the backdrop of financial market jitters, the continuing conflict in Ukraine and a looming election. Critic or supporter – perhaps that very much depends on the extent to which the (lengthy) budget represents a […]