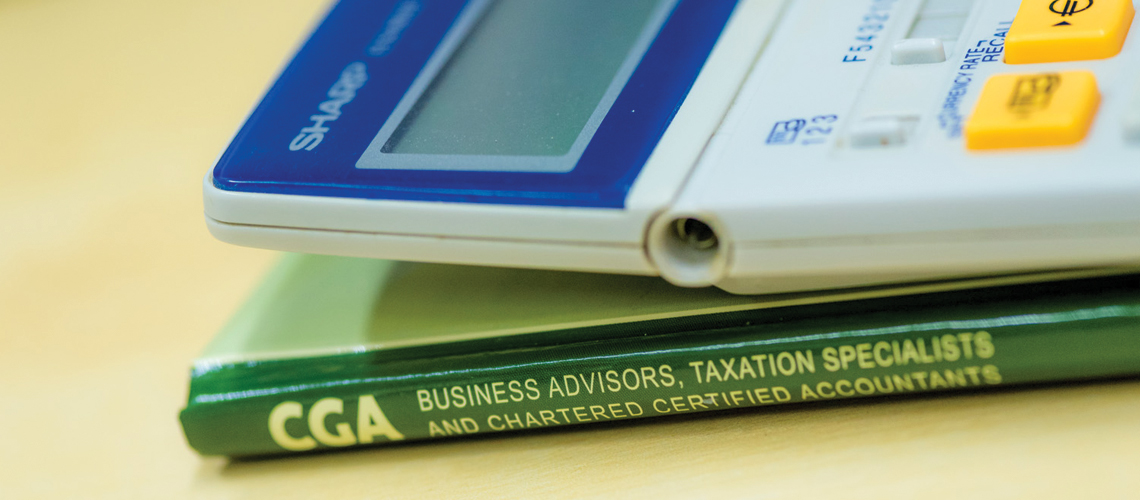

Company director? Self-employed? Property Owner?

Most people don’t need to complete an annual tax return, for instance those of us who simply receive employment income and have some bank interest. If, however, your financial affairs are slightly more complicated you may need to submit a tax return to HM Revenue and Customs.

Perhaps you are a company director, receive self-employment income, own rental property or have other sources of untaxed income. In which case we’re here to help.

More gain less pain

“A diehard number phobic, CGA had their hands full with me but, down to their commitment, coaching and encouragement, I now use a computerised accounting package that helps ensure I make better business decisions. I also really appreciate their proactive, forward thinking, which means I can better manage and plan my finances to support my life and business in the future.” Margaret Hartley, Benchmark Marketing

Answering all your questions, guiding you through the whole process and completing the form on your behalf, we’ll take away any stress and frustration, guiding you through the whole process of self-assessment.

Rest assured you are will be fully compliant for your tax return and other relevant forms. We will also make sure you are fully aware of forthcoming deadlines so that you are not hit by penalties. And that’s not all…

Reducing your tax bill

We help you reduce your tax bill to a minimum, as we constantly monitor and apply current tax rates, capped personal allowances and any tax relief available to you.

Capital Gains Tax

Due on the profits made from the sale of capital assets, such as property or shares, we can advise you of the best timing of the sale and look at different reliefs that may be available to keep the tax you pay down to a minimum or even reduce it to nothing. Planning is key so talk to us as soon as you can and we’ll get the right strategy in place for you.

Inheritance Tax

Least considered yet often has the greatest impact on your family’s future wealth. It is essential to plan for your family’s future and keep Inheritance Tax to a minimum. A very complex area, we’re here to give you options, help and advice.

Find our more about our full range of CGA accountancy services.