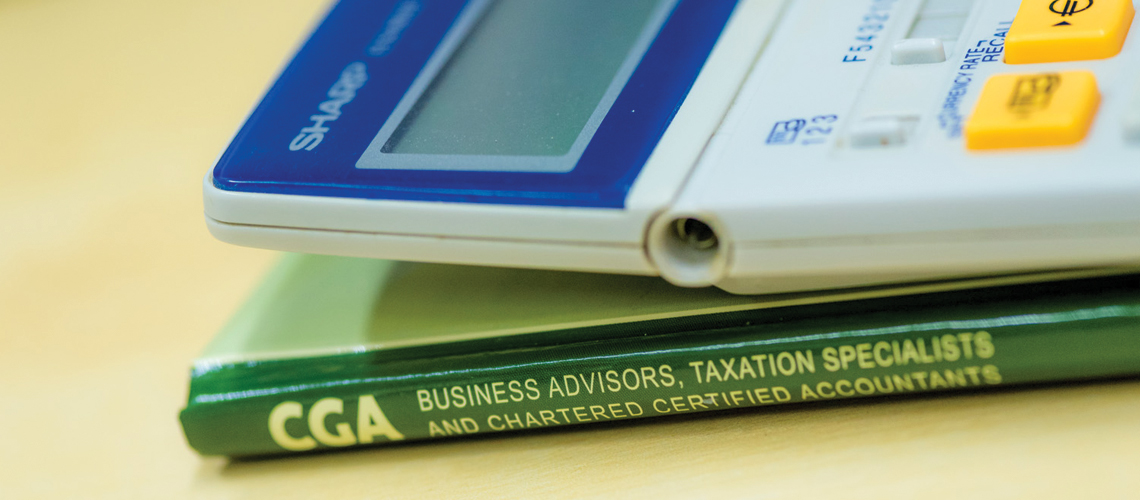

All businesses and self-employed people in financial distress, and with outstanding tax liabilities, may be eligible to receive support with their tax affairs through HMRC’s Time To Pay service. These arrangements are agreed on a case-by-case basis and are tailored to individual circumstances and liabilities.

If you are concerned about being able to pay your tax due to COVID-19, call HMRC’s dedicated helpline on 0800 0159 559.

GOV.UK Guidance

COVID-19: Support for businesses paying tax

Coronavirus VAT deferment: Get the details right

Many UK businesses are at risk of losing out on the coronavirus three month VAT deferment if they do not act immediately.

After announcing the easement on 20 March, HMRC followed up with a Q&A warning direct debit payers that they must contact their banks to cancel the facility or the VAT will automatically be withdrawn in the next few days.

Other details remain confusing, including repayment dates and payments on account. Taxpayers who use mini one-stop shop returns (MOSS) are not included in the scheme.

£30bn VAT payments suspended till 30 June 2020

On 20 March, the new Chancellor, Rishi Sunak, announced a three month VAT payment deferment lasting until 30 June 2020. This amounts to a £30bn credit line for over two million businesses. The tax holiday will be automatic – see direct debit payer risk below – although businesses may still go ahead and pay now if they wish. Taxpayers do not have to notify HMRC if they intend to take advantage of the payment holiday.

Any VAT due will be payable by the end of the 2020/21 financial year, which is 31 March 2021. This is the date for monthly VAT payers. However, the position is more complex for most VAT-registered businesses that are on quarterly staggers.

HMRC has yet to confirm their position. But the likely payments dates will be, depending on return due dates: 31 March 2021; 30 April 2021; or 31 May 2020.

There will be no interest or default surcharges due on deferred VAT. VAT credits and refund will be paid as normal during the period.

VAT returns still due; MTD phase 2 kicks in

Importantly, VAT returns must still go in on time by the 7th of the relevant month.

As HMRC has not postponed the launch of the new Making Tax Digital for VAT phase two, so all businesses above the VAT registration threshold are obliged to introduce digital bookkeeping and the full digital journey.

The latter means no manual adjustments to data, consolidating in spreadsheets, or using ‘cut and paste’. The regular VAT penalty regime for missing any MTD obligations also comes into play on 1 April 2020 when the one-year soft-landing phase of MTD ends.

Direct debit payers at risk

One major glitch in the plan is taxpayers on direct debit. HMRC will automatically withdraw the VAT declared in the VAT return. They cannot stop this process. So any direct debit payer must contact their bank immediately to cancel the payment.

Mixed messages for some VAT payers

After initial confusion, foreign businesses with a UK VAT registration have been confirmed as eligible for the VAT deferral. However, any businesses filing for B2C electronic services sales have been excluded. They will have to pay the VAT due as normal. There are no details yet on payment-on-account payers. But we assume there will be a postponement, too?

What happens after June?

Given the deepening economic gravity of the COVID-19 situation, it is entirely possible that there will be an extension in July to this VAT deferment. So direct debit payers should pause before reinstating their payments. And we should all keep tuned.