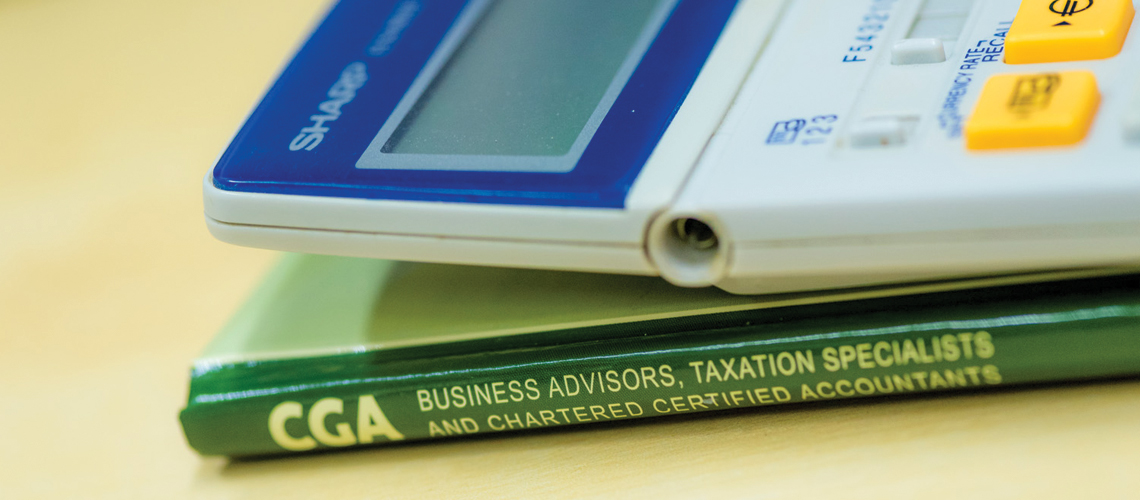

Self-Employed Income Support Scheme SEISS – June 2021 Update

Self-Employed Income Support Scheme SEISS June 2021 Update – Fifth Grant The fifth grant will cover the period May 2021 to September 2021 – guidance for claiming should be available for the end of June. What’s different about the fifth grant? The fifth grant will be determined by how much your turnover has been reduced […]