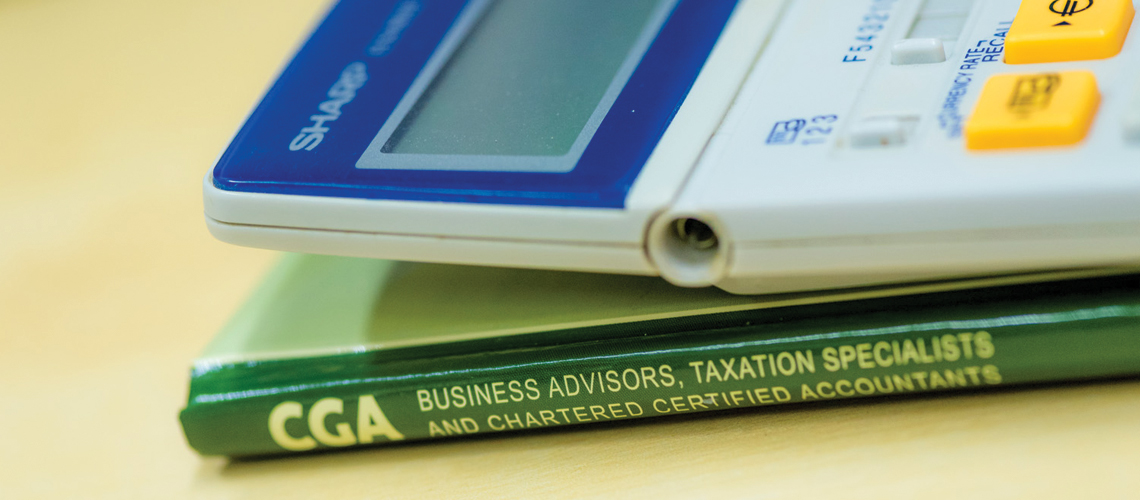

Working from home may be an attractive option for some employees, however in the light of Covid, for some employees this is now the only option albeit temporarily.

Here we consider the tax implications of homeworking arrangements.

Your status is important

The tax rules differ considerably depending on whether you are self-employed, as a sole trader or partner, or whether you are an employee, even if that is as an employee of your own company. One way or the other though, if you want to maximise the tax position, it is essential to keep good records. If not, HMRC may seek to rectify the tax position several years down the line. This can lead to unexpected bills, including several years’ worth of tax, interest and penalties.

General rules

Generally, any costs paid on behalf of, or reimbursed to, an employee by their employer will be taxable. The employee will then have to claim the personal tax relief themselves and prove that they incurred those costs ‘wholly, exclusively and necessarily’ in carrying out their job. The word ‘necessarily’ creates a much tighter test than that for the self-employed.

In addition, the way in which the services are provided can sometimes make a substantial difference to that tax cost. For example, if the employer provides something for the employee, the rules are often much more generous than if the employee bought it themselves and attempted to claim the tax relief. A bit of advice and forward planning can often prove to be fruitful.

An exemption

The rules for employees in relation to ‘use of home as office’ contains a specific exemption from a tax charge. They allow payments made by employers to employees for additional household expenses to be tax free, where the employee incurs those costs in carrying out the duties of the employment under homeworking arrangements. ‘Homeworking arrangements’ means arrangements between the employee and the employer under which the employee regularly performs some or all of the duties of the employment at home.

The arrangements do not need to be in writing but it is advisable to do this, as the exemption does not apply where an employee works at home informally.

Where these rules are met, the additional costs can be met.

- additional heating and lighting costs

- additional insurance

- metered water

- telephone or internet access charges

- business rates (if applicable)

Only the increase in costs incurred by the employee can be reimbursed. Costs that would be the same whether or not you work at home cannot be included. Such costs might include:

- mortgage interest or rent

- council tax

- water rates

For costs such as broadband internet connection, HMRC say that if the employee is already paying for a connection before starting working from home then this is an existing expense and cannot be reimbursed tax-free. If, however, the employee is not connected to broadband and needs a connection to work from home, then this would qualify as an additional cost which the employer could reimburse tax-free.

The same principles will apply for the cost of a domestic landline rental. Only additional costs incurred by the employee as a result of homeworking can be reimbursed by their employer tax-free.

The employer is also not permitted to reimburse tax-free any costs that put the employee in a position to work at home such as building alterations. However, the employer can provide office equipment and office furniture. These would be tax-free benefits in kind. (Although see below for tax issues that can arise where the employee provides their own equipment.)

A simpler flat rate method is available to cover additional costs. The rate has increased from £4 a week to £6 a week from 6 April 2020. No records are required to be kept. However, to justify a higher payment, the message is: prove it!

Tax relief

The above rules only allow tax free payments to be made in specific circumstances. However, if payments are made outside of these rules or, in fact, no payments are made at all, the employee can claim personal tax relief themselves if they can prove that they incurred those costs or received those payments ‘wholly, exclusively and necessarily’ for the purposes of their job. In reality this is extremely difficult – some would say impossible – as HMRC requires the following tests to be met:

- the employee performs the substantive duties of their job from home (i.e. the central duties of the job)

- those duties cannot be performed without the use of appropriate facilities

- no such facilities are available to the employee on the employer’s premises or are too far away

- and at no time either before or after the employment contract is drawn up is the employee able to choose between working at the employer’s premises or elsewhere.

So the moral for employees is to go for tax free payments, not tax relief!

Purchases of Office Equipment

It is generally accepted that working solely on a laptop for long periods is poor practice, and can lead to discomfort and back pain. Some new homeworkers will need additional equipment including monitors, keyboards and even desks and chairs in order to make a functional office space at home. Fortunately, following an announcement on 13 May 2020, some of the unintended outcomes which could arise here have been dealt with by the Government.

Employer purchase

If the employer has purchased and provided any necessary equipment then, provided there is no significant private use, no taxable benefit in kind arises on the employee.

(If there is significant private use, then a benefit in kind will arise and so employers may wish to ensure that their employment policies make clear private use is not permitted.)

If, at a later date, ownership of the asset is transferred from the employer to the employee then a benefit in kind could arise.

Employee purchase and employer reimburses

In the current circumstances, some employees may have purchased their own equipment personally in order to get set up as soon as possible. Employers may even have advised this, and offered to reimburse the costs afterwards.

Usually, employer reimbursements of employee expenses are treated differently for tax purposes and this approach involving a subsequent reimbursement is normally taxable on the employee. This is clearly unwelcome, and therefore the announcement on of a temporary exemption from income tax and national insurance for such reimbursements is very welcome.

Temporary COVID-19 exemption

This introduces as a temporary measure for 2020/21 – there will also be, by discretion, an exemption for the period 16 March 2020 to 5 April 2020 when much homeworking will have started – provisions for any reimbursement by an employer for the cost of equipment to be exempt from income tax and national insurance as long as it was:

- provided for the sole purpose of enabling homeworking as a result of coronavirus

- and would have been tax exempt if provided directly by the employer.

Furthermore, any private use of the reimbursed equipment should not be significant.

As this exemption has been laid under powers provided for by section 210 of ITEPA 2003 (power to exempt minor benefits) – and equivalent sections for NICs – so any exemption is conditional on the benefit being made available to all an employer’s employees generally on similar terms. Therefore, employers should ensure that similar reimbursement terms apply to all employees that need to work from home. It will not, for example, be acceptable for directors to ensure that they are reimbursed for office equipment but other staff are not.

If at some point in the future the employee returns to work and retains the equipment, HMRC have confirmed via guidance that no benefit in kind will arise at that point.

Employee purchases and employer does not reimburse

If the employer is unable or unwilling to reimburse equipment costs then employees will need to see if they are able to satisfy the conditions to claim tax relief through capital allowances.

This requires them to demonstrate that the equipment is used in the performance of their duties and they are likely to struggle to obtain relief under capital allowances under current HMRC guidance.

Relief on office furniture such as desks and chairs will be particularly challenging as arguably they put the employee in a (more comfortable) position to do their duties, rather than being used in the actual duties themselves. .

Accordingly, employees will be best off seeking reimbursement from their employer for costs of office furniture, as tax relief from HMRC is unlikely. Where they are seeking relief for office equipment used in their duties, then tax relief is more possible.