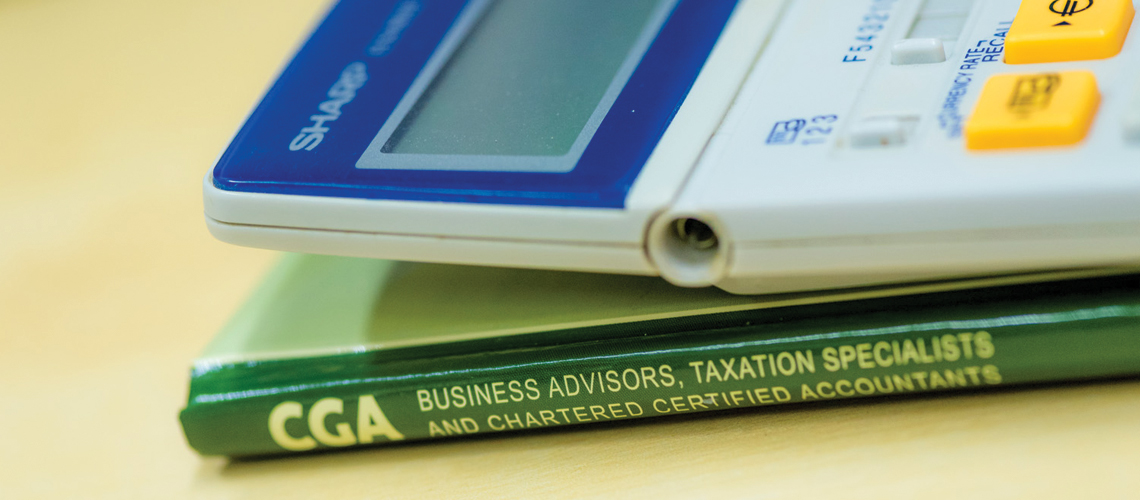

Gifts and Inheritance Tax

When you make a gift to third parties you are potentially transferring part of your estate and a life-time charge to IHT may be applied. However, in most cases you will not need to open your cheque book as there are a number of exemptions that may cover your intended gifts. The current gift exemptions […]