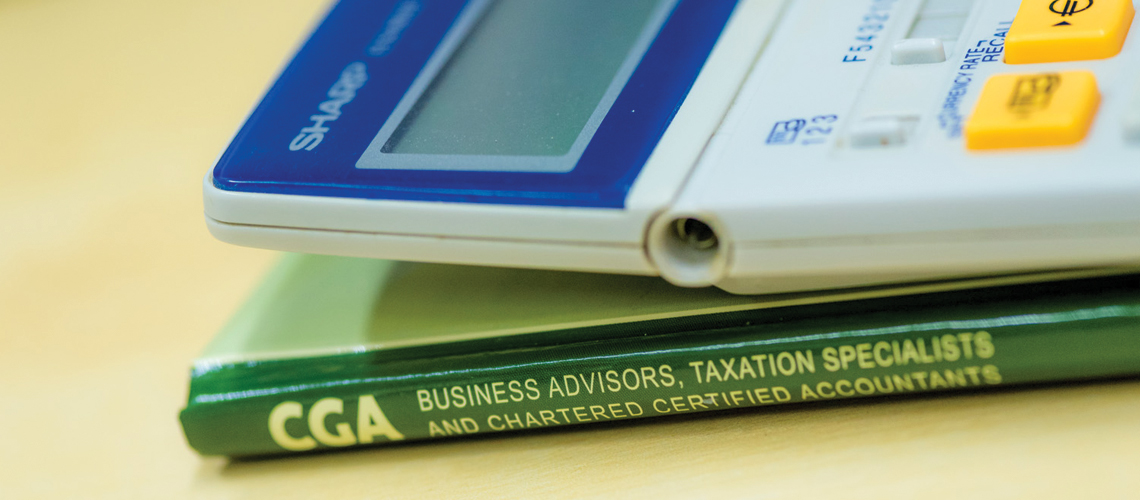

Stamp duty changes – residential property

In his recent Summer Statement, Rishi Sunak announced changes to the nil rate band of Stamp Duty Land Tax (SDLT) to be applied in England and Northern Ireland. This was followed by announcements from the Scottish and Welsh regional assemblies who set the rates in Scotland and Wales. Here is a brief summary of the […]